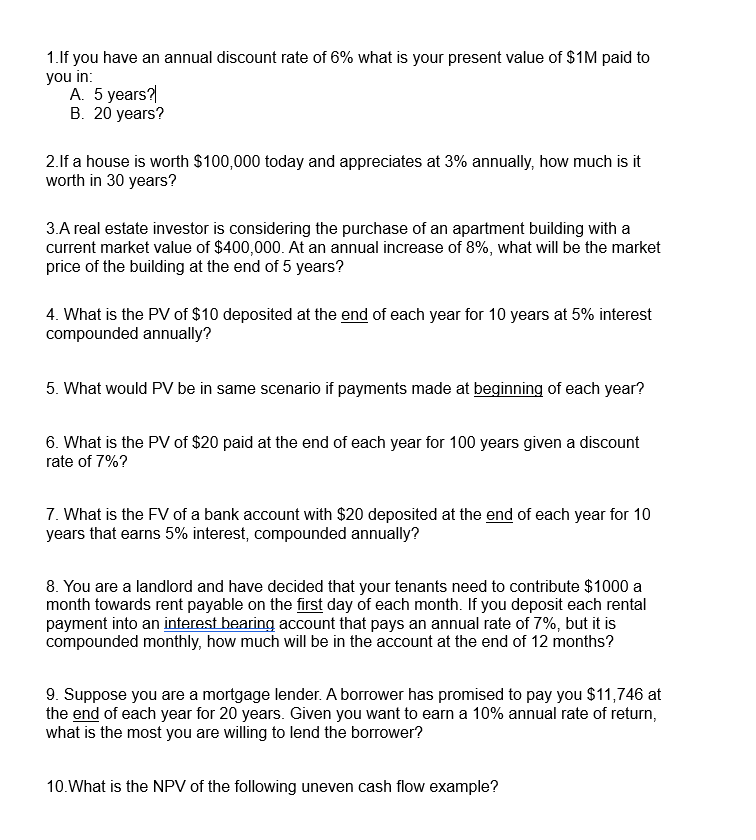

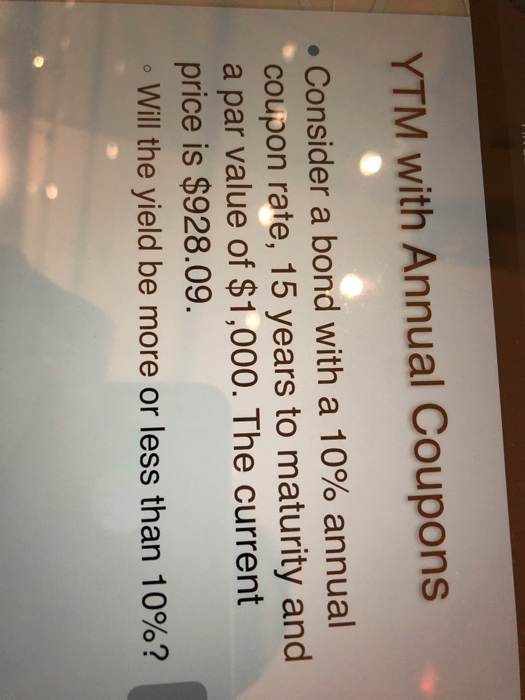

39 relationship between coupon rate and ytm

quizlet.com › 95524462 › cfa-53-introduction-toCFA 53: Introduction to Fixed-Income Valuation - Quizlet Matrix pricing is used in underwriting new bonds to get an estimate of the required yield spread over the benchmark rate. The benchmark rate is typically the yield-to-maturity on a government bond having the same, or close to the same, time-to-maturity. The spread is the difference between the yield-to-maturity on the new bond and the benchmark ... Yield to Maturity - YTM vs. Spot Rate. What's the Difference? The spot interest rate for a zero-coupon bond is the same as the YTM for a zero-coupon bond. Yield to Maturity (YTM) Investors will consider the yield to maturity as they compare one bond offering...

› yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

Relationship between coupon rate and ytm

EOF What relationship between a bond's coupon rate and a bond's yield would ... Answer (1 of 5): Thanks for the A2A. All the bonds have coupon interest rate, sometimes also referred to as coupon rate or simply coupon, that is the fixed annual interest paid by the issuer to the bondholder. Coupon interest rates are determined as a percentage of the bond's face value but diff... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

Relationship between coupon rate and ytm. Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 Study Notes If the coupon rate < YTM, the bond will sell for less than par value, or at a discount. If coupon rate= YTM, the bond will sell for par value. Over time, the price of premium bonds will gradually fall until they trade at par value at maturity. Similarly, the price of discount bonds will gradually rise to par value as maturity gets closer. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A... What relationship between a bond's coupon rate and ... - Quora Oct 13, 2016 — YTM is yield to maturity or total return the bond will generate to its holder if held till the maturity date of the bond or NCD. YTM is the discounted rate of ...5 answers · 7 votes: Thanks for the A2A. All the bonds have coupon interest rate, sometimes also referred to as ...What is the difference between the YTM and the ...4 answersJul 20, 2020What is the relationship between YTM and the discount ...3 answersMar 11, 2015Can you explain the relationship between a bond's ...3 answersOct 13, 2016What relationship between the required return and the ...4 answersDec 6, 2021More results from The Relation of Interest Rate & Yield to Maturity - Pocketsense Most brokerage firms offer YTM estimates on potential purchases, and there are number of online calculators you can use to make estimates based on coupon rate and maturity date. In the example, if you paid a premium for the same six-year bond, say $101, your estimated YTM would decrease to about 4.8 percent, or about $28.80.

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. The Relationship Between a Bond's Price & Yield to Maturity Yield to maturity is the percentage of total return you can expect to receive when you buy a particular bond at a specific price. Yield to maturity includes both the interest payments you receive from a bond along with the capital gain you receive at maturity, if any.The lower the price you can pay for a particular bond, the higher your yield to maturity will be, all other factors being equal. › terms › bBond Yield Definition Jan 01, 2022 · Its coupon rate is the interest divided by its par value. If interest rates rise above 10%, ... Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. YTM is ...

Difference Between Coupon Rate and Yield to Maturity (With ... The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value.Rate: It remains the same for the entire yearFormula: Annual Payment/Face Value × 100 Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Relation Between Bond Price and Yield - Risk and Return The relation between bond price and Yield to maturity (YTM) YTM is the total return anticipated on a bond if the bond is held until its lifetime. It is considered as a long-term bond yield but is expressed as an annual rate. Basically, YTM is the internal rate of return of an investment in the bond if the following two conditions are satisfied: Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the coupon rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and coupon rate is 2.375%.

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Difference between Coupon Rate And Yield To Maturity Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ...Face value: 10%

What is the relation between the coupon rate on a bond and its duration ... The yield to maturity of a bond is the discount rate that sets the present value of the promised bond payments equal to the current market price of the bond. In this way, what is the relationship between a bond's price and its yield? Coupon rate—The higher a bond's coupon rate, or interest payment, the higher its yield.

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Estimate the interest rate by considering the relationship between the bond price and the yield. You don’t have to make random guesses about what the interest rate might be. Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate.

Relationship Between Coupon and Yield - Assignment Worker Coupon rate = 14%, semiannual coupons YTM = 16% Maturity = 7 years Par value = $1,000 Slide 14 6-14 Example 7.1 • Semiannual coupon = $70 • Semiannual yield = 8% • Periods to maturity = 14 • Bond value = • 70 [1 - 1/ (1.08)14] / .08 + 1000 / (1.08)14 = 917.56 ( ) ( )2t 2t 2 YTM1 F 2 YTM 2 YTM1 1 -1 2 C Value Bond + + + =

The Relation of Interest Rate & Yield to Maturity - Zacks The yield to maturity is the yield that you would earn if you held the bond to maturity and were able to reinvest the coupon payments at that same rate. It is the same number used in the bond ...

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

What relationship between a bond's coupon rate and a bond's yield would ... Answer (1 of 5): Thanks for the A2A. All the bonds have coupon interest rate, sometimes also referred to as coupon rate or simply coupon, that is the fixed annual interest paid by the issuer to the bondholder. Coupon interest rates are determined as a percentage of the bond's face value but diff...

EOF

Post a Comment for "39 relationship between coupon rate and ytm"