45 present value of zero coupon bond calculator

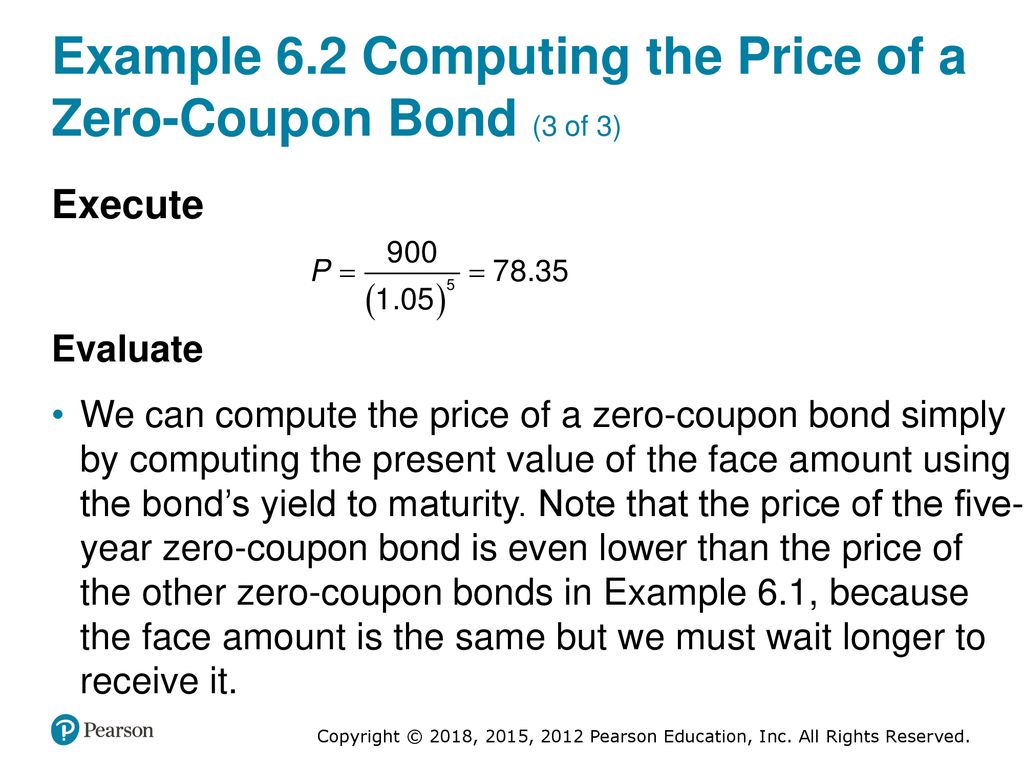

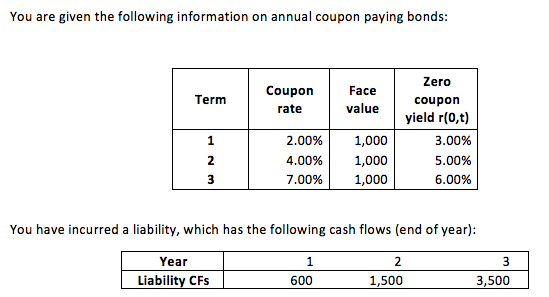

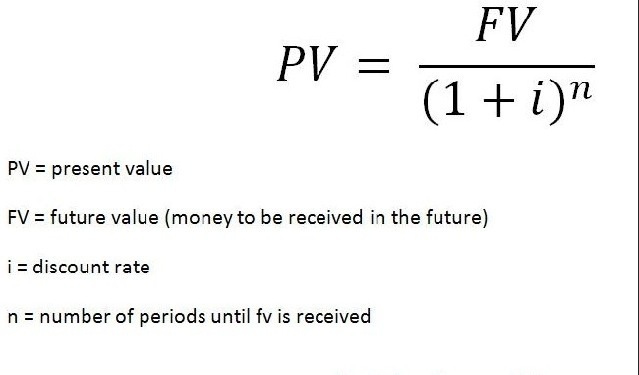

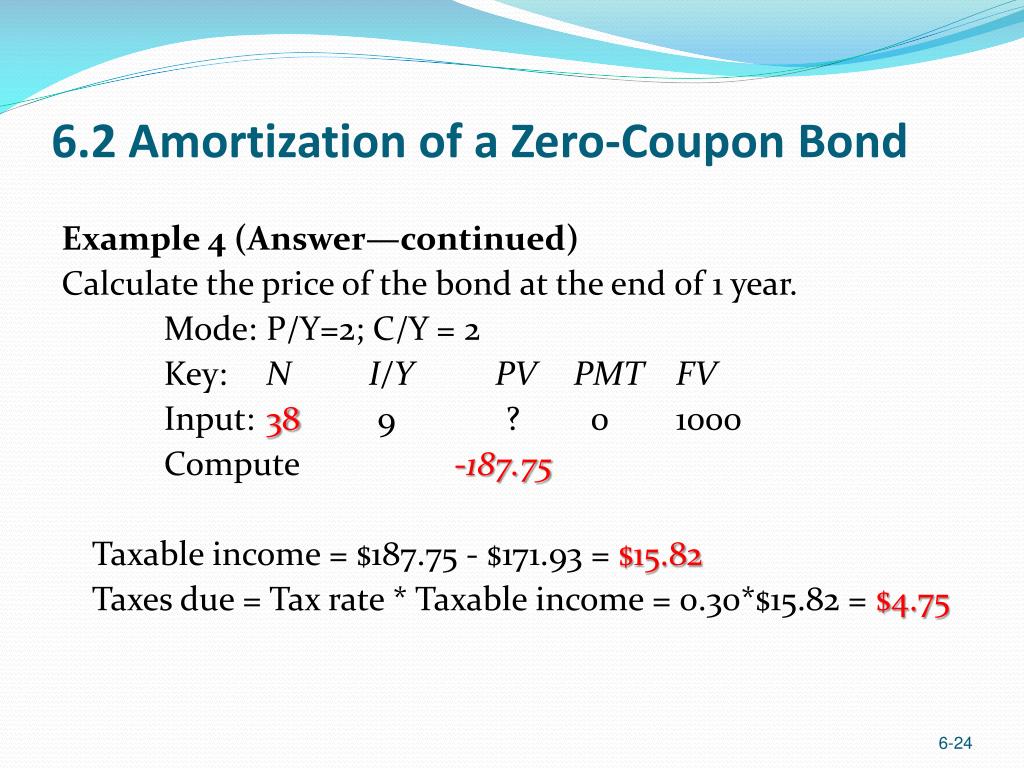

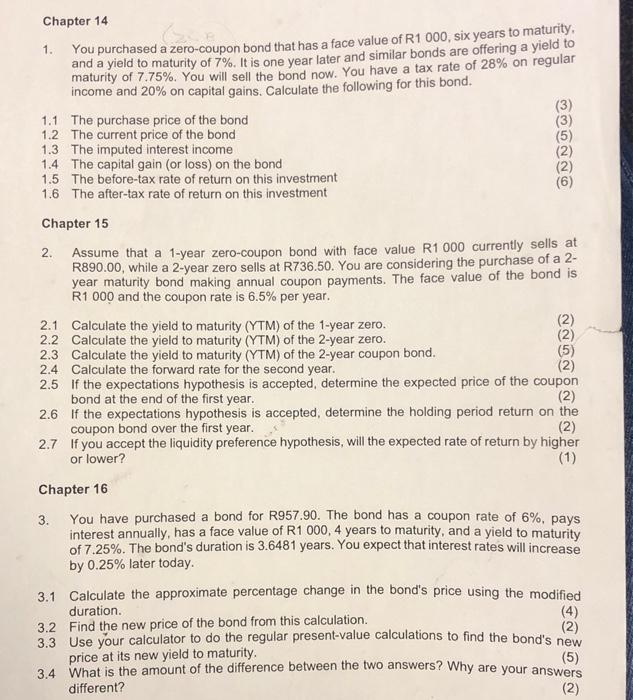

Zero-Coupon Bonds: Characteristics and Examples To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

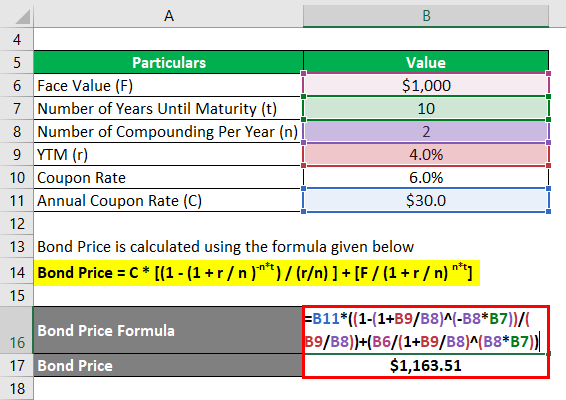

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Present value of zero coupon bond calculator

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ... Zero Coupon Bond Calculator - MiniWebtool About Zero Coupon Bond Calculator . The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. How to Calculate PV of a Different Bond Type With Excel - Investopedia The Accrued Interest = ( Coupon Rate x elapsed days since last paid coupon ) ÷ Coupon Day Period. For example: Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% ...

Present value of zero coupon bond calculator. Zero Coupon Bond Effective Yield Calculator Zero Coupon Bond Effective Yield is used to calculate the periodic return for a zero-coupon bond, or sometimes referred to as a discount bond and is represented as ZCB Yield = (F/PV)^ (1/n)-1 or Zero Coupon Bond Effective Yield = (Face Value/Present Value)^ (1/Number of Periods)-1. Face value is the nominal value or dollar value of a security ... How do you find the present value of a coupon bond? As shown in the formula, the value, and/or original price, of the zero coupon bond is discounted to present value. To find the zero coupon bond's value at its original price, the yield would be used in the formula. After the zero coupon bond is issued, the value may fluctuate as the current interest rates of the market may change. Zero-Coupon Bond Value Calculator - MYMATHTABLES.COM Zero-Coupon Bond Value Calculator This online calculator is used to calculate the zero-coupon bond price, yield to maturity and spending power at maturity. Face value at maturity ($) Interest rate (APR %) Years to maturity Months to maturity Annual inflation rate (%) Marginal income tax rate (%) Results... Zero Coupon Bond Price = $914.54 Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as. This formula will then become. By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top. Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments) Zero Coupon Bond Value Formula - Crunch Numbers How to calculate the price of a zero-coupon bond? Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM. Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is ... Zero Coupon Bond Value Calculator - Find Formula, Example & more Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5 When we solve the equation barely by hand or use the calculator we put up, the product will be Rs.747.26.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. Calculate the Value of a Zero-coupon Bond - Finance Train Calculate the Value of a Zero-coupon Bond. Suppose you have a pure discount bond that will pay $1,000 five years from today. The bond discount rate is 12%. What is the appropriate price for this bond? Since there are no interim coupon payments, the value of the bond will simply be the present value of single payment at maturity. Bond valuation (Zero coupon bonds) |Calculator - Trignosource Zero-coupon bond pricing refers to finding out the fair value of a zero-coupon bond, which is simply the present value of the redemption amount of that bond ...

Zero Coupon Bond - Explained - The Business Professor, LLC 17 Apr 2022 — Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin {aligned}=\left (\frac {1000} {925}\right)^ {\left...

Calculating Present and Future Value of Annuities - Investopedia 25.04.2022 · For example, you could use this formula to calculate the present value of your future rent payments as specified in your lease. Let's say you pay $1,000 a month in rent.

Present Value Calculator home / financial / present value calculator Present Value Calculator This present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments. Present Value of Future Money Future Value (FV) Number of Periods (N) Interest Rate (I/Y) Results Present Value: $558.39

Zero Coupon Bond Value Calculator | Calculate Zero Coupon ... Zero Coupon Bond Value calculator uses Zero Coupon Bond Value = Face Value/ (1+Rate of Return/100)^Time to Maturity to calculate the Zero Coupon Bond Value, Zero Coupon Bond Value is referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments, and instead pays one lump sum at maturity.

Calculate Zero-coupon Bond Purchase Price Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Solved Calculate the present value of a $1,000 zero-coupon - Chegg Compute your rate of return if you sell the bond next year for $880.10. 7. Calculate the duration of a $1,000, 6% coupon bond with three years to maturity. Assume that all market interest rates are 7%. Expert Answer 100% (1 rating) 1. Present value of zero coupon bond = Face valu … View the full answer Previous question Next question

Zero Coupon Bond Calculator - Nerd Counter Zero-Coupon Bond Yield = F 1/n PV – 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Zero Coupon Bond Value Calculator - BuyUpside.com Zero Coupon Bond Value Calculator Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Bond Convexity Calculator

Zero Coupon Bond Calculator – What is the Market Value? Zero coupon bonds have a duration equal to their time until maturity, unlike bonds which pay coupons. Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bondsthan regular bonds mat...

Zero Coupon Bond Value Calculator - StableBread Bond Pricing Calculator: Clean/Flat Price, Dirty/Market Price, and Accrued Interest. Credit Spread Calculator. Current Yield Calculator. Tax-Equivalent Yield (TEY) Calculator. Yield to Call (YTC) Calculator. Yield to Maturity (YTM) Calculator. Zero Coupon Bond Effective Yield Calculator.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with ...

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

How to Calculate PV of a Different Bond Type With Excel - Investopedia The Accrued Interest = ( Coupon Rate x elapsed days since last paid coupon ) ÷ Coupon Day Period. For example: Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% ...

Zero Coupon Bond Calculator - MiniWebtool About Zero Coupon Bond Calculator . The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "45 present value of zero coupon bond calculator"