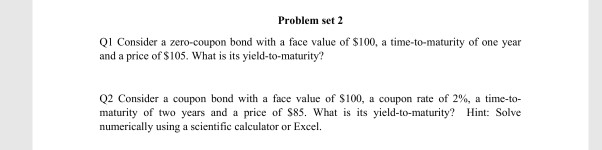

39 valuing zero coupon bonds

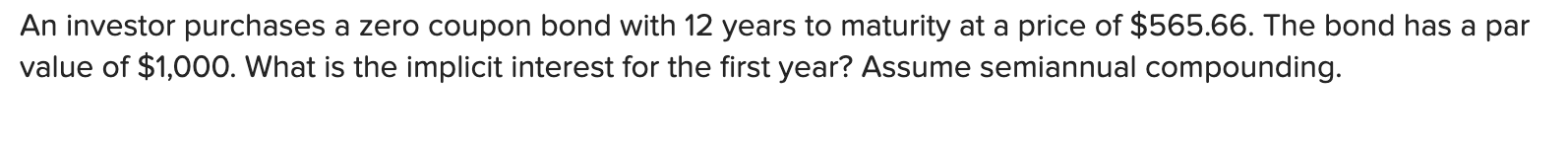

Reserve Bank of India - Frequently Asked Questions i) Fixed Rate Bonds – These are bonds on which the coupon rate is fixed for the entire life (i.e. till maturity) of the bond. Most Government bonds in India are issued as fixed rate bonds. For example – 8.24%GS2018 was issued on April 22, 2008 for a tenor of 10 years maturing on April 22, 2018. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

CFA 53: Introduction to Fixed-Income Valuation - Quizlet The spot curve, also known as the strip or zero curve, is the yield curve constructed from a sequence of yields-to-maturities on zero-coupon bonds. The par curve is a sequence of yields-to-maturity such that each bond is priced at par value.

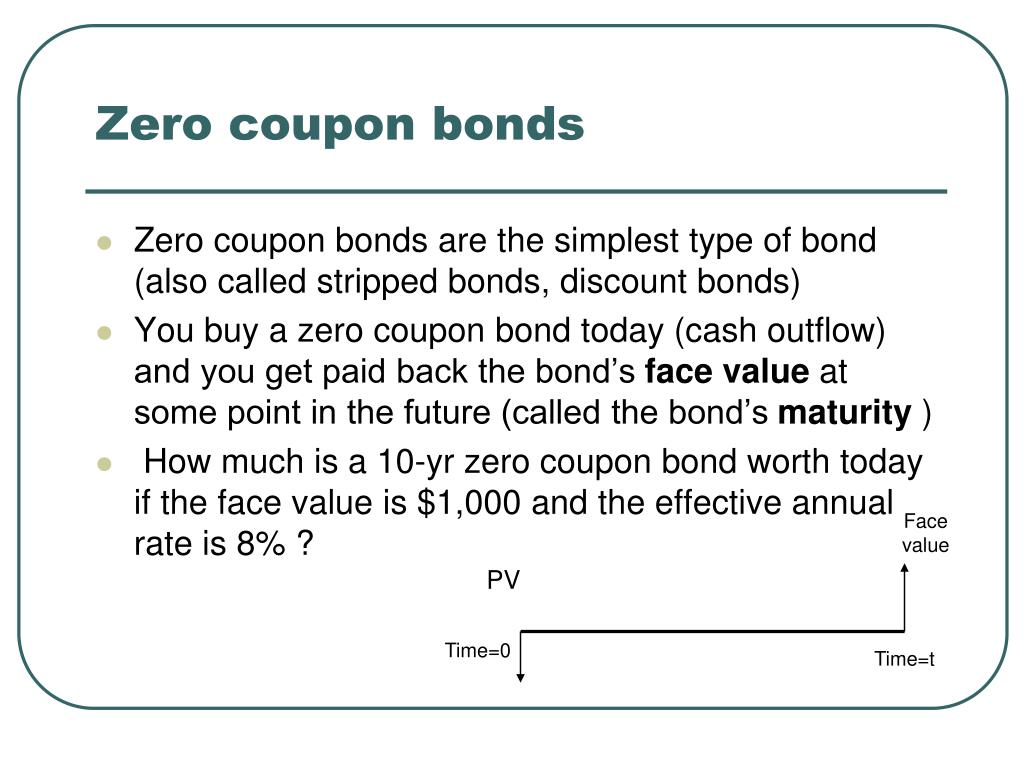

Valuing zero coupon bonds

Zero Coupon Bond Calculator - What is the Market Value? What's the zero coupon bond pricing formula? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP. where: P: The par or face value of the zero coupon bond. r: The interest rate of the bond. t: The time to maturity of the bond. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Valuing zero coupon bonds. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. So, the under the given procedure will be applied to have the demanded answer easily: $4000 (1+.3)20; $4000; 190.049637748; $21.05 How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ... Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations. Zero Coupon Bond: Definition, Formula & Example - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ...

Valuing a zero-coupon bond | Mastering Python for Finance - Second Edition Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, y is the annually-compounded yield or rate of the bond, and t is the time remaining to the maturity of the bond. Let's take a look at an example of a five-year zero-coupon bond with a face value of $ 100. The yield is 5%, compounded annually. 75.40 - General Ledger Account Codes - Wa Zero-Coupon (GO) Rate Bonds Payable . 5165: Zero-Coupon Bonds - Accreted Interest Payable: 5167: General Revenue Bonds Payable - Internal Lending (UW Only) 5169. Other Bonds Payable : 5170 - SHORT-TERM INSTALLMENTS AND LEASES PAYABLE. 5171. Installment-Purchase Contracts Payable . 5172. Lease-to-Own Agreements Payable . 5173. Certificates of Participation/Notes Payable … Advantages and Risks of Zero Coupon Treasury Bonds General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000... Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero-Coupon Bond Definition - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates... Fundamentals of Finance | Coursera From valuing claims and making financing decisions, to elements of a basic financial model, the coursework provides a solid foundation to corporate finance. The specialization then moves to financial accounting, enabling learners to read financial statements and to understand the language and grammar of accounting. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. PDF Numerical Example in Valuing Zero coupon Bonds For example, the value of a zero coupon bond will increase from $385.00 to $620.92 as the bond moves from 10 years to maturity to 5 years to maturity assuming interest rates remain at 10%. 4) Compare the value of the zero at 10 years to maturity when rates are 10% versus when they are 7%. Lower interest rates mean higher bond prices.

Zero coupon bond definition — AccountingTools What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond.

Valuing a zero-coupon bond - Mastering Python for Finance [Book] A zero-coupon bond is a bond that does not pay any periodic interest except on maturity, where the principal or face value is repaid. Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, is the annually compounded yield or rate of the bond, ...

How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ...

Zero Coupon Bonds - Financial Edge Training Value and YTM of Zero Coupon Bonds. Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity.

Net Asset Value (NAV): Formula and NAV Per Share Calculation Net Asset Value (NAV) and Mutual Funds. The net asset value (NAV) commonly appears in the context of mutual funds, as the metric serves as the basis for setting the mutual fund share price.. NAV on a per-unit basis represents the price at which units (i.e. ownership shares) in the mutual fund can be purchased or redeemed, which is typically done at the end of each trading day.

Zero Coupon Bond Value Formula - Crunch Numbers Example of YTM of a zero-coupon bond calculation Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is $9,100. There are 2 years until maturity. katex is not defined YTM of this bond is 4.83%.

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... The price of zero-coupon bonds is calculated using the formula given below: See also What Are the Equity Valuation Methods? 5 Methods And 2 Categories Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity

The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Glossary of pensions terms and abbreviations - Pinsent Masons 01.12.2011 · AA rated bonds (slightly higher risk) are used as the basis for valuing pension scheme liabilities in company accounts. AAF 01/06 Guidance issued by the ICAEW to provide guidance to reporting accountants on undertaking an assurance engagement and providing a report in relation to the internal controls of a service organisation, issued in June 2006 and revised in June 2009 (replacing …

Where's the greenium? - ScienceDirect Apr 01, 2020 · Additionally, although green bonds are, on average, 2.4 years longer than the general universe of standard issues, their yields are 5.4 basis points lower. Finally, green bonds are significantly more likely to be issued by large issuers, with a statistically significant difference of approximately 51.8% between the green and non-green samples.

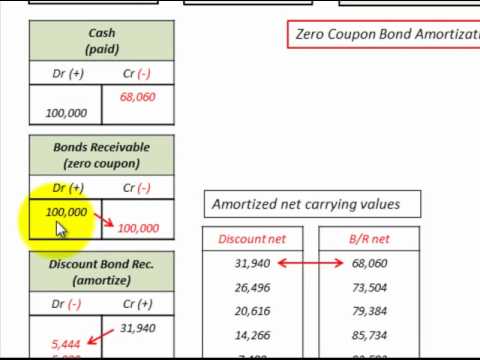

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method

Zero Coupon Bonds Explained (With Examples) - Fervent | Finance Courses ... Valuing Zero Coupon Bonds on Excel® We'll be using Excel's "PRICE" function to value Swindon Plc's bond. The first thing you want to do is setup your spreadsheet with a pro-forma / template that consists of the all different variables you'll need. The "PRICE" function on Excel® requires:

(PDF) Sales Promotions - ResearchGate 01.01.2012 · difficulty is that retailers can misredeem the discount deliver y vehicle (e. g., coupon) without a redemption, i.e., submit coupo ns for redemption that were not submitted b y consumers with ...

Pricing of Swaps, Futures, & Forward Contracts | CFA Institute With a basic understanding of pricing and valuing a simple interest rate swap, it is a straightforward extension to pricing and valuing currency swaps and equity swaps. The solution for each of the three variables, one notional amount (NA a ) and two fixed rates (one for each currency, a and b), needed to price a fixed-for-fixed currency swap are :

Solved 2. Valuing a Zero-Coupon Bond. Assume the following | Chegg.com 2. Valuing a Zero-Coupon Bond. Assume the following information for existing zero-coupon bonds: Par value = $100,000 Maturity = 3 years Required rate of return by investors = 12% How much should investors be willing to pay for these bonds?

Understanding Zero Coupon Bonds - Part One - The Balance Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value. Some issuers may call zeros before maturity. You must pay tax on interest annually even though you don't receive it until maturity. Zero coupon bonds are more volatile than regular bonds. Of the three kinds of zero coupon bonds ...

Post a Comment for "39 valuing zero coupon bonds"